Cash flow modelling is the process of looking at your current financial situation and planning ahead for the future. We can assess your assets, investments, debts and income and use the information to help predict assumed rates of growth, income, inflation and more.

Advantages of cash flow modelling:

- Helps highlight how much money you could have in the future

- Gives you clarity and reassurance of your future scenarios

- Generates a plan to ensure you can reach your financial goals and live the lifestyle you desire

UNDERSTANDING YOUR FINANCIAL FUTURE

How does Cash Flow Modelling work?

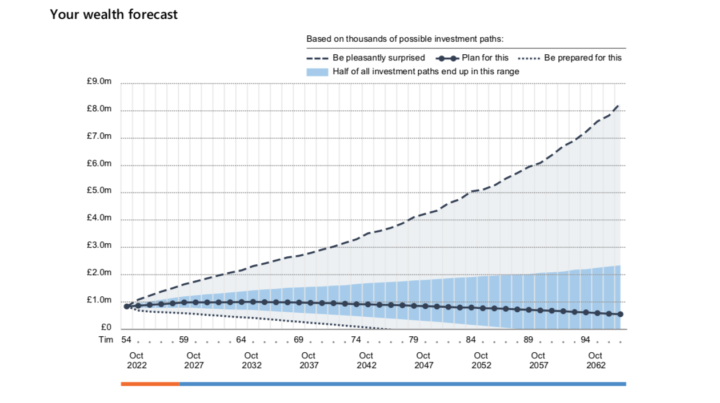

Our financial advisers will collect information about your finances such as your monthly income, savings, outgoings and debt, and discuss your future financial goals and aspirations. Based on your input, they will provide a report that includes easy-to-understand graphs and visuals that show your future cash flow based on rates of investment growth, inflation and potential earning increases.

some BENEFITS OF CASH FLOW MODELLING

Cash flow modelling helps assess all financial scenarios such as unfortunate illness, deaths, retirement or saving for your children’s education. All this information is taken into account to help plan the next financial years and to find out if you are on track to meet your goals. It will also help identify any increase or decrease in your assets as well as any surplus or shortfalls.

Capital at risk.

What questions will Cash Flow Modelling help me answer?

- Will I have enough money to stop working when I want to?

- Am I saving enough for retirement?

- Do I have enough protection in place if I can not work or pass away?

- Will my family be financially secure if I go into care or die unexpectedly?

- Do I have enough money to reach my financial goals?

- What can I do to ensure I reach my financial aspirations?

- Will I run out of money later in life or can I spend more now?

- How can I minimise my tax liabilities?