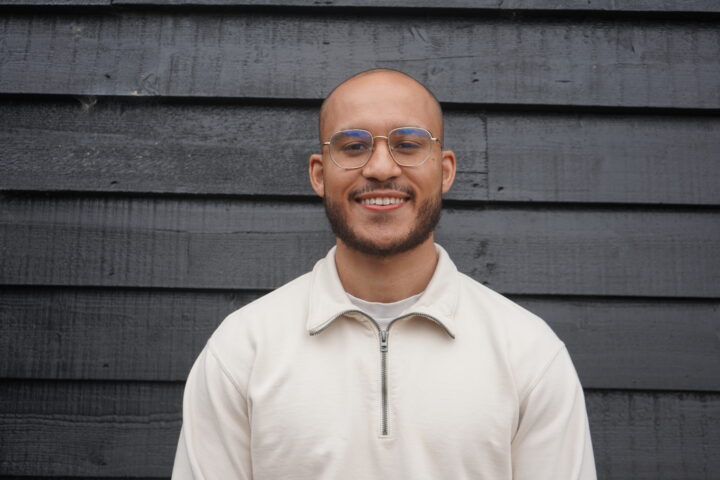

Taylor Forde- Financial Planning Administrator

Meet Taylor Forde, the most calm and collected individual in the Headway Wealth team. Having worked at an insurance and pension provider before, Taylor came to Headway Wealth wanting to be part of our forward-looking and all-encompassing financial planning approach. We sat down with him to find out more about his journey to us, his ambitions in the finance profession, his passion for fitness, and the best personal and financial advice he’s ever received.

What led you to choose this career?

I actually went to university for a sports management degree thinking that would be a career I’d want to pursue. I originally wanted to be a physiotherapist for a professional football club to help top tier athletes. However, it was during my studies that I realised I didn’t want to be in that field because the job I would want is very competitive and only available for the top 0.5 percent. It’s a profession you have to be passionate about, it requires a lot of dedication, and it’s not compensated properly.

Although my current role as Paraplanner Trainee is not related to what I studied, a lot of the skills you use within the role are very similar to what I previously wanted to do. A physiotherapist needs to focus on the client, gather as much information about them to address their needs and problems through a structured plan, which is very similar to what we do in financial planning. When I first started working for an insurance and pension provider, it opened my eyes to the field, the career opportunities it offers are endless and I find it quite fulfilling to help others with their finances.

What do you enjoy about your job?

I love learning new things and enhancing my knowledge on all-things personal finance to help individuals with their money. It involves some problem-solving where you’re given a bit of information and you have to figure out why something’s happened or what the result of doing something else could be.

I also enjoy the analytical aspect of my role where we look at specific investments, understand their performance over the last few years and compare them to the initial recommendation we made to the client. And I find it fascinating how geopolitics, the global markets and population trends can impact someone’s investment portfolio.

What do you enjoy the most ABOUT YOUR JOB?

I enjoy writing reports for clients because you get an oversight of everything related to that client. From their portfolio’s performance to the specific financial products they hold and the benefits they offer to them. At Headway Wealth, we also have a very diverse client base in different parts of the world so we work with various products and providers and that gives me exposure to providing more holistic financial advice no matter where the client is located.

What would you be doing instead?

That’s a tough question. Given my background, perhaps something to do with sports, maybe working for a football club in an office or management role.

Best advice ANYONE HAS GIVEN YOU

The first piece of advice is to follow your goals and desires because at the end of the day, people don’t really care about you. It sounds horrible but oftentimes we are worried about what others might think of us and we are held back by this fear of embarrassment. But they’re genuinely more concerned about themselves so just do what makes you happy.

The second piece of advice is to focus on the positive when dealing with adversity. Instead of having a victim mindset when you’re experiencing something challenging, try to view the positive aspects of that experience. Focus on the strength and mental resilience you will acquire from overcoming obstacles in life. It’s all about perspective.

Any business icons?

I find Phil Knight, founder and former CEO of Nike, fascinating. He faced a lot of troubles and tribulations to establish one of the most powerful and iconic brands that exist today. He transformed an entire category through his aspirational brand, established key partnerships with athletes like Michael Jordan (created Air Jordan) and literally changed people’s perceptions of sportswear. Back then, sportswear was just for sports but thanks to his progressive thinking and ambition to reach a wider audience, he made sportswear mainstream and popular for everyday use.

Who do you most admire?

I don’t “admire” anyone and I don’t believe we should ever put anyone on a pedestal. Humans are flawed, we all have our good and bad traits.

Do you have any hobbies?

I like sports in general. I play football regularly and Muay Thai (Thai Boxing). My uncle exposed me to Muay Thai when I was a teenager but I never pursued it until recently. After lockdown and years of saying I was going to try it, I finally did and I quickly fell in love with it.

What I love most about it is that you learn every single time you go. You could be the most experienced person in the ring but every opponent is different so you have to learn and strategise on the spot in order to win. It offers a lot of mental benefits too because it requires a lot of determination, confidence and resilience. Your mind needs to be a lot stronger than your body because when you’re physically tired, you need to dig deep to continue and finish the fight. It teaches you discipline and is great cardio too.

I also enjoy combat sports such as boxing or MMA.

Why did you choose to work for headway?

It’s a small company that enables me to get hands on experience with the whole Financial Planning process. Normally you might be shoe-horned into a specific area of financial planning, only dealing with a certain type of project or a certain type of client, so having a broader experience at the early stages of my career, is something I really appreciate.

Since we work with clients all over the world, we have a more diverse set of products and offerings to help expats and UK residents. Because it is a young and modern company, our management offers great flexibility. They understand that you don’t need to be in the office five days a week for 9 hours a day to get the best out of your employees.

WHAT ARE your future aspirationS?

I think in the medium term I would like to become a qualified Paraplanner. In the long term, I would like to be an adviser but I’m not necessarily in a rush and that I don’t want to be fast tracked. I’m more content with gaining enough experience to be able to put myself in that position.

Best financial tips

Invest when you’re young. Open an ISA and invest in an index fund to negate inflation, or put your money into a cash fund with good interest.